The S&P 500 just hit a new all-time high. It seems that we are back to a raging bull market. One company driving this is Netflix.

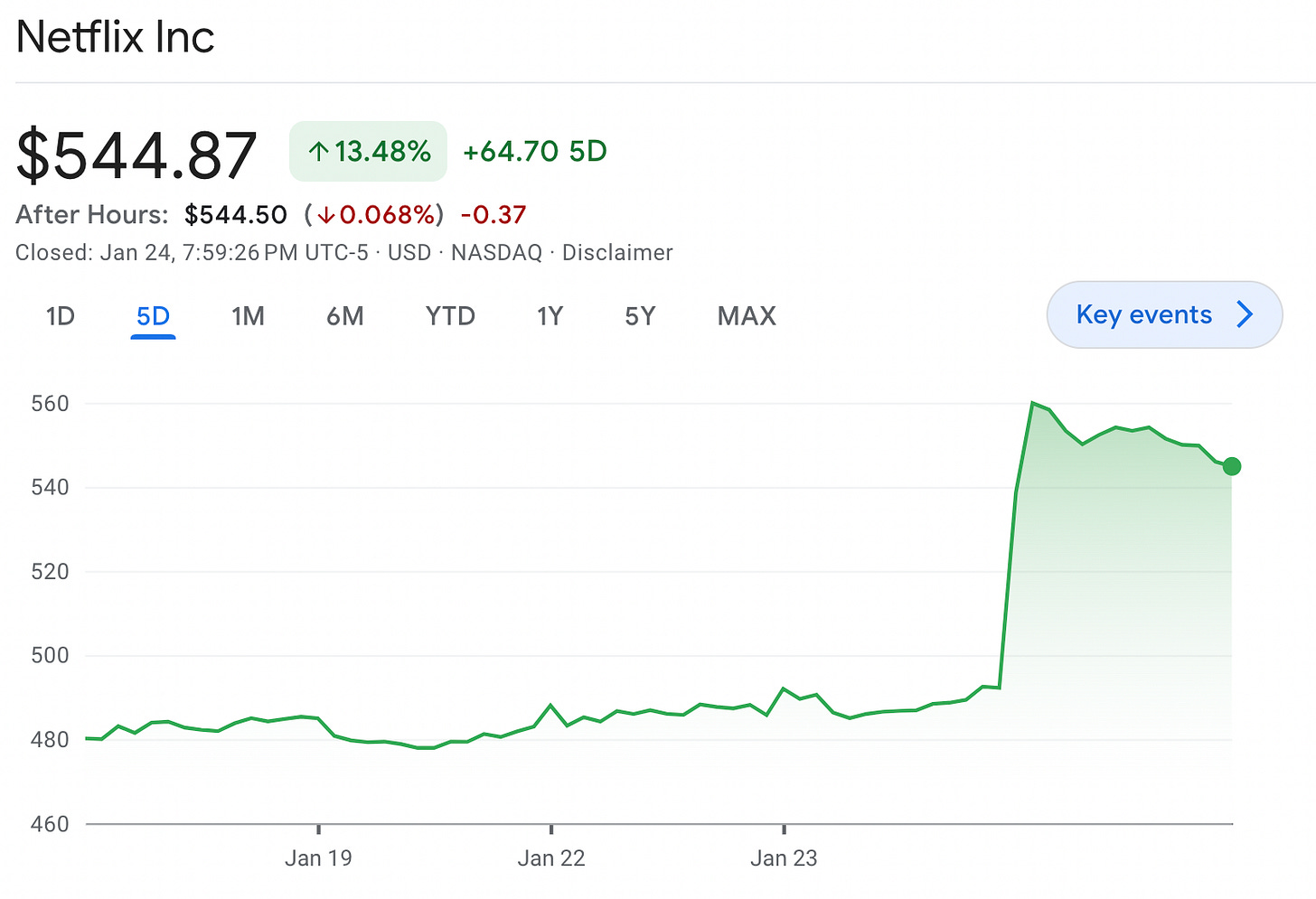

Netflix shares leaped more than 12% after its earnings report yesterday. From stagnating subscriber growth in Q1 2022 to roof-shattering growth in Q4 2023, this is unimaginable! Q4 2023 report is here.

From Yahoo Finance:

Earnings per share (EPS) slightly missed estimates in the quarter with the company reporting EPS of $2.11, below consensus expectations of $2.20. The company reported EPS of $0.12 in the year-ago period.

Still, Netflix guided to first quarter EPS of $4.49, ahead of consensus calls for $4.09.

Profitability metrics also came in strong with operating margins sitting at 16.9% for the fourth quarter and 21% for full-year 2023, ahead of the company's 20% target.

Free cash flow came in at $1.58 billion in the quarter, above consensus calls of $1.26 billion. The company increased its free cash flow to $6.9 billion for full-year 2023 ahead of Netflix's guidance of $6.5 billion amid the impact of last year's double Hollywood strikes.

Average revenue per member, or ARM, was up 1% year over year, in line with the company's expectations of "roughly flat year-over-year." Wall Street analysts expect ARM to pick up later this year as both the ad tier impact and price hike effects take hold.

On the ads front, ad-tier memberships increased by nearly 70% quarter over quarter, the company said in the earnings release. The ads plan now accounts for 40% of all Netflix sign-ups in the markets it's offered in.

Earlier this month, Netflix said the ad tier has surpassed 23 million monthly active users, up 8 million from its November update.

The recent surge in stock price was driven by two major news:

Netflix added 13.1 million new subscribers in the last quarter of 2023, beating Wall Street's prediction of 8.91 million users. This is its biggest subscriber acquisition since the pandemic.

Acquisition of exclusive rights to RAW from WWE, marking Netflix's first big move into live events. It will be paying $5B throughout the 10-year deal.

Many legacy media companies invested heavily in streaming during the pandemic, which made the space very competitive for Netflix. Unfortunately, they are now pulling back. Everyone got so excited about streaming and felt it was easy to replicate.

But most realize they are incapable; they don't have the resources, technical knowledge, and financial commitment to do the business. The competitive environment is relaxed, giving Netflix more room to grow. In Netflix's words:

…Continuing to improve our entertainment offering is so important, and as many of our competitors cut back on their content spend, we continue to invest in our slate."

It's also not just the high-end, expensive drama driving this insane growth for Netflix. It is the low-cost ad-supported television. 40% of new subscribers are on the ad tier.

The same show people watch on cable networks, they can now stream on Netflix. For ad-supported businesses, you need to be in sports or news. Sports command high viewership and audience that advertisers want to reach.

Netflix went for the number 1 show on the USA TV Network -RAW and purchased exclusive rights for the next ten years. They had to enter this space to drive high viewership and support their ad business.

Any streaming product is competing with YouTube at the fundamental level. YouTube gives most of its products for free. It has 122 million daily users and 2.7 billion monthly active users. In fact, it's the biggest TV network on earth.

To succeed, streaming platforms need to figure out how to take away market share from YouTube or borrow from their business model.

More streaming platforms are turning to ad-supported subscriptions. Amazon Prime Video, for instance, is moving all subscribers to an ad-supported platform starting Jan. 29 unless they opt to pay an additional $3 a month for an ad-free experience.

The days of subscriber-only revenue are gone. If you are running a consumer subscription business, your growth will hit a ceiling at some point. First, the attractive feature of subscription business -predictable recurring revenue -tends to attract bad subscription businesses. Secondly, Consumers will end up subscribing to products/services they are not using. The bills will add up. Users will see how much they pay every month and realize that it’s no longer worth it.

Many subscription businesses began as startups. The model is very attractive to investors, so they can raise money quickly with the hopes that they will acquire as many customers as possible. They often start by losing money on CAC, hoping that the LTV will cover the costs in the long term.

Sometimes, they offer discounts or freemium access to ramp up the acquisition numbers. Their goal is to establish economies of scale to reduce the per-unit cost of their product/service. Many subscription businesses don’t get to achieve this. They realize that to acquire more customers, they must invest more in content production or service delivery, which drives up costs. They will be forced to jack up prices, leading to customer churn. Netflix was at this point in 2022 when it reported a loss of 200,000 subscribers.

But Netflix has proven to be a very resilient business and has a massive opportunity to keep growing.

If we continue to execute well and drive continuous improvement — with a better slate, easier discovery and more fandom — while establishing ourselves in new areas like advertising and games, we believe we have a lot more room to grow. It’s a $600B+ opportunity revenue market across pay TV, film, games and branded advertising — and today Netflix accounts for only roughly 5% of that addressable market. And our share of TV viewing is still less than 10% in every country. But it all starts with the consumer. Because when we delight our members, we can drive more engagement, revenue and profit than the competition — creating an increasingly valuable entertainment company (for our members, content creators and shareholders) that will strengthen and grow over time.

With the success of its ad tier and crackdown on password sharing, its growth story is not ending soon. Its journey into live events (specifically gaming) will dramatically change the TV streaming business in the next few years.